Data from CoinMarketCap & Alternative.me as of Jan 28, 2026. Verify before trading.

Seven weeks ago, we covered Bitcoin Cash as our Coin of the Week when it was trading at $562. The thesis was simple: clean supply dynamics (no token unlocks, no VC overhang) combined with steady whale accumulation made it a standout performer of 2025.

Since then, BCH tested higher levels, pulled back, and is now setting up again. What caught our attention this week was the quality of the signals Freya picked up. The data shows accumulation characteristics: selling volume dries up on dips, buying picks up after, and large holders keep adding rather than distributing.

This follow-up article breaks down the new signals, the upcoming May 2026 upgrade catalyst, the updated price levels, and the risks that could derail the setup. If you read our December analysis, consider this the continuation of that thesis.

Who this is for: Traders looking for data-driven altcoin opportunities with clear technical levels. We present the facts. You make the decisions.

Bitcoin Cash (BCH) was created in August 2017 as a hard fork of Bitcoin. The split happened because a group of developers believed Bitcoin should prioritize fast, cheap payments rather than solely focusing on being a store of value.

The BCH developers chose payments. They increased the maximum block size to 32MB, prioritizing higher on-chain throughput and lower fees. Bitcoin uses a different constraint model (block weight), but the practical result is that BCH transactions typically cost less than a penny and confirm faster.

The May 15, 2025 network upgrade activated VM Limits and BigInt, enabling more expressive smart contracts on BCH. A planned May 2026 upgrade (often discussed in community circles as "Layla") aims to further enhance these capabilities. Separately, the SmartBCH sidechain provides EVM compatibility for developers seeking Ethereum-style smart contracts.

Our market intelligence system flagged several signals around BCH over the past week. Here's what stood out:

Freya identified accumulation characteristics in BCH's order flow. Selling volume dried up during the recent pullback, while buying volume picked up immediately after.

Net buying is rising across both spot exchanges and futures markets. When large holders accumulate during fear (Fear & Greed at 44), they are typically positioning for a move they expect to come.

Recent derivatives data shows top traders on Binance are positioned approximately 71% long on BCH. When professional traders on major exchanges lean heavily in one direction, it often reflects conviction about near-term price direction.

The clean supply dynamics argument from December still holds: no token unlocks, no foundation treasury selling, and no VC overhang. When there's less forced selling, accumulation can actually move price. BCH broke through the $600 sell wall with no significant resistance until $634-$640.

No analysis is complete without understanding what can go wrong. Here's what you need to consider:

| Risk Factor | Level | Details |

|---|---|---|

| $634-$640 Resistance Zone | HIGH | BCH was rejected at this zone multiple times in late 2025. Sellers are clearly present. A fourth rejection could trigger a deeper pullback. |

| Market Fear Environment | MEDIUM | Fear & Greed at 44 means sentiment is cautious. Altcoins can face sudden sell pressure if BTC weakens further. |

| Competition From Privacy Coins | MEDIUM | Monero briefly surpassed BCH by market cap in mid-January 2026. Privacy narratives are drawing attention away from payment-focused coins. |

| Upgrade Execution Risk | MEDIUM | The May 2026 network upgrade is planned but final specs are not yet confirmed. Delays or implementation issues could dampen the narrative. |

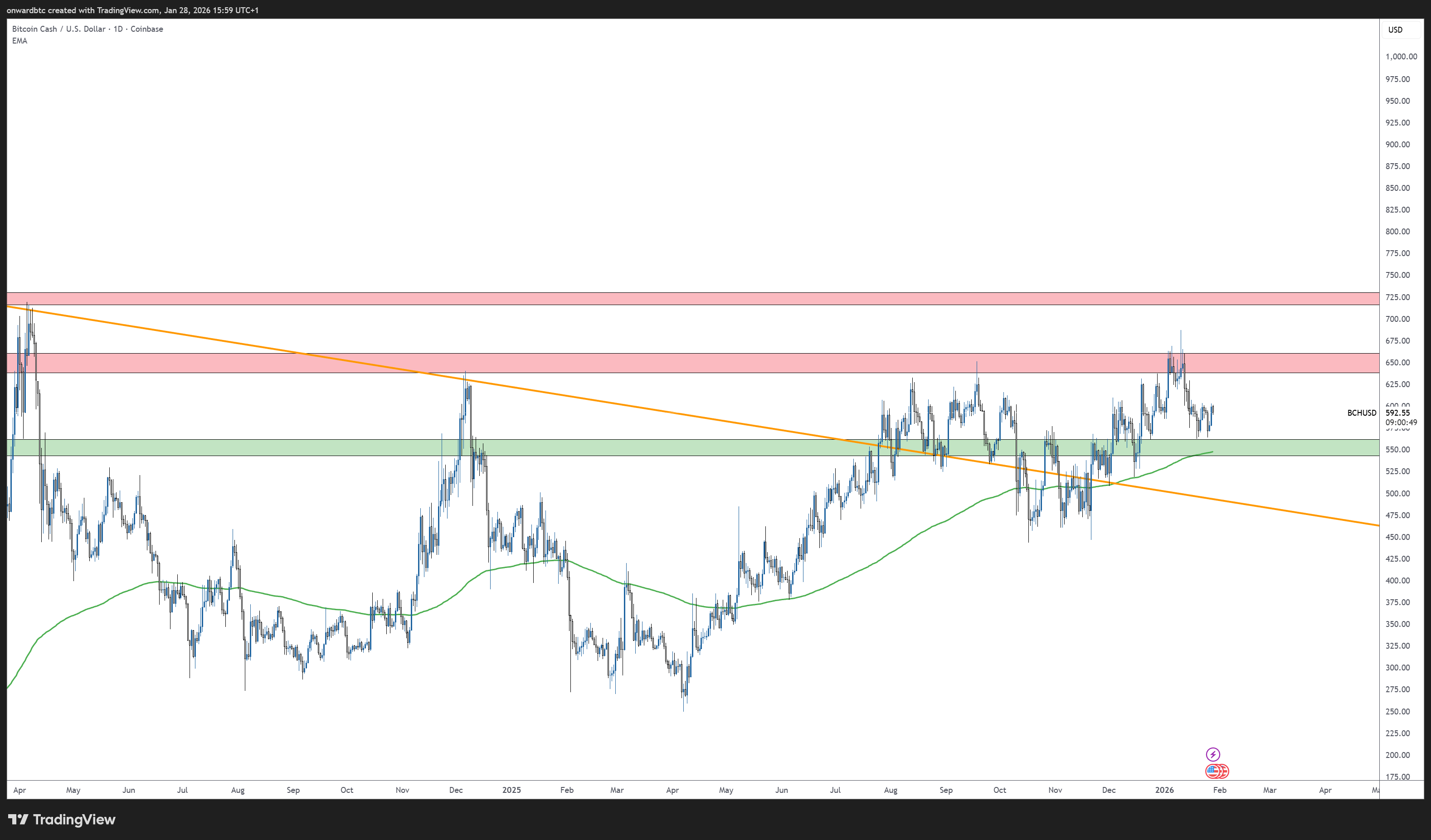

Here's what the charts are showing:

If BCH loses the $563 support level, the next major support sits at $480, representing roughly 15% downside from current prices. A break below $480 would invalidate the bullish structure.

The planned May 2026 network upgrade (often discussed as "Layla" in BCH community circles) aims to enhance smart contract capabilities on BCH's base layer, building on the May 2025 VM Limits and BigInt improvements. Post-quantum cryptography has been mentioned in roadmap discussions as a longer-term goal. Confirm final specs against official BCH documentation as the date approaches.

BCH was recently integrated with THORSwap and NEAR Intents, enabling swaps with 120+ assets across different blockchains. This is an interoperability feature for trading, expanding BCH's accessibility across the crypto ecosystem.

On January 20, 2026, CoinDesk Indices rebalanced the trading venues used to calculate the BCH benchmark rate for the Grayscale Bitcoin Cash Trust. Binance and Gate BCH-USDC pairs were added while Bitfinex was removed. This improves price discovery and liquidity tracking for institutional investors.

The $634-$640 resistance zone is your decision point. If BCH breaks through with volume, consider the $720 target viable. For entries, pullbacks to the $570-$580 range offer better risk-reward than chasing at current levels. Set stops below $563 to protect against a failed breakout.

The May 2026 upgrade provides a potential catalyst with a defined timeline. Position traders often build exposure ahead of known events and reduce into strength as the event approaches. The clean supply dynamics (no unlocks, no VC overhang) remain a structural advantage.

The $634-$640 zone provides clear rejection points for shorts if momentum stalls. The $563-$580 support zone offers bounce plays. Fear & Greed at 44 means volatility can spike in either direction. Size down and respect your stops.

The May 2026 network upgrade (often discussed as "Layla" in BCH community circles) aims to enhance smart contract capabilities on BCH's base layer, building on the May 2025 VM Limits and BigInt improvements. Post-quantum cryptography has been mentioned in roadmap discussions as a longer-term goal. For EVM-compatible smart contracts, the SmartBCH sidechain already provides that functionality. Confirm final upgrade specs against official BCH documentation as the date approaches.

Accumulation patterns often precede significant price moves. When large holders buy during periods of market fear (current Fear & Greed Index is 44), it suggests they expect future appreciation. The key signal is that whales are stacking rather than selling into rallies, indicating they believe current prices represent value rather than an exit opportunity.

BCH and BTC share the same origin but serve different purposes. Bitcoin prioritizes security and store of value. Bitcoin Cash prioritizes transaction speed and low fees with a 32MB block size limit. BCH transactions typically cost less than a penny and confirm faster, making it more practical for everyday payments. Both have the same 21 million maximum supply.

The key resistance zone is $634-$650. If BCH breaks through with volume, the pattern target is $720. On the downside, $563 is the first major support, with $480 as critical support below that. A break below $480 would invalidate the current bullish structure. These levels are based on Freya's analysis of order flow and historical price action.

We don't give investment advice. What we can tell you: the data shows accumulation signals, clean supply dynamics, and an upcoming upgrade catalyst. It also shows a strong resistance zone at $634-$640, competition from privacy coins, and cautious market sentiment. Make your own decision based on your risk tolerance and trading style.

Freya monitors markets 24/7 and delivers insights like these directly to your Telegram. No charts to decode. No confusion. Just professional intelligence.

Try Free for 30 DaysNo credit card required • Cancel anytime

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency trading involves substantial risk of loss. Past performance does not guarantee future results. The price data, whale activity analysis, and technical levels presented are based on available information at time of publication and may change rapidly. Always do your own research and consider your financial situation before making investment decisions. Never invest more than you can afford to lose.