Data from CoinMarketCap, CoinGecko & Alternative.me as of Jan 7, 2026. Verify before trading.

Solana just hit a milestone that puts it in elite company. As of January 6, 2026, Solana-based exchange-traded funds have crossed $1 billion in total assets under management. That makes SOL only the fourth cryptocurrency to achieve this threshold, joining Bitcoin, Ethereum, and XRP.

The timing is notable. SOL is trading around $138, down 53% from its January 2025 all-time high of $294.85. The broader market sentiment sits in "Fear" territory (index at 41). Yet institutional money keeps flowing in. Bitwise's BSOL alone holds $732 million, and Morgan Stanley just filed paperwork for their own Solana trust.

Meanwhile, Freya has been tracking notable activity in the derivatives market: positioning skews heavily toward longs while shorts get liquidated. When this happens during a fearful market, the setup often precedes significant moves. This article breaks down what the data shows, the key levels to watch, and the risks you need to consider.

Who this is for: Traders looking for institutional-grade setups in Layer-1 blockchains, anyone tracking the ETF adoption wave, and swing traders watching for breakout confirmation above key resistance.

Solana is a high-performance Layer-1 blockchain designed for speed and scalability. While Ethereum processes roughly 15-30 transactions per second, Solana can handle up to 65,000 TPS at Layer 1 with a block time of just 400 milliseconds. The average transaction fee is $0.00025, making it one of the cheapest networks to use.

The network achieves this performance through a unique consensus mechanism called Proof-of-History (PoH), combined with Proof-of-Stake. This hybrid approach creates a historical record of events that reduces the computational work needed to validate transactions. It solves what developers call the "blockchain trilemma" of balancing speed, security, and decentralization.

Solana launched in 2020 and quickly became a hub for DeFi protocols, NFT marketplaces, and blockchain gaming. In 2025, Solana DEXs processed over $1.5 trillion in trading volume according to DeFiLlama, while network and application revenue exceeded $1.4 billion. The RWA (Real World Assets) ecosystem on Solana reached $873 million per RWA.xyz, up 325% year-over-year. Separately, stablecoin supply on the network has grown substantially, with USDC alone exceeding $9 billion.

Our market intelligence system flagged several significant signals around SOL over the past week. The combination of extreme long positioning, ongoing short liquidations, and institutional ETF flows creates a compelling setup. Note: Positioning data is from Freya's internal monitoring systems.

According to Freya's internal aggregation of major derivatives venues, long positioning on SOL significantly outweighs shorts. While public aggregators show mixed readings, our data suggests leveraged traders are betting heavily on upside. This level of conviction often precedes significant directional moves.

Short positions have been actively liquidated during recent rebounds. When shorts get flushed, it removes one layer of downside pressure and can accelerate rallies if momentum builds.

Solana ETFs have now accumulated $1.02 billion in assets under management, crossing this threshold on January 6, 2026. This makes SOL only the fourth crypto asset to reach this milestone after Bitcoin, Ethereum, and XRP.

According to SoSoValue data, cumulative net inflows have reached approximately $775 million. Per CoinShares reports, Solana fund products saw roughly $3.6 billion in inflows during 2025, up from $310 million in 2024, representing approximately 1,000% year-over-year growth.

Freya's monitoring shows large leveraged positions accumulating on SOL. When institutional-sized players maintain profitable leveraged exposure during consolidation phases, it often signals confidence in further upside.

Long positions on SOL continue to grow while short interest remains subdued. This divergence in positioning suggests that larger players are preparing for a move higher rather than hedging against downside.

The ETF milestone and positioning data are constructive, but significant risks remain. Here is what you need to consider:

| Risk Factor | Level | Details |

|---|---|---|

| Crowded Long Positioning | HIGH | Freya's data shows positioning skews heavily long. A sharp move down could trigger cascading liquidations. When many traders are on the same side, reversals can be violent. |

| 53% Down from ATH | MEDIUM | SOL is still recovering from a 55% drawdown in Q4 2025. While the bottom may be in, failed rallies could lead to retests of lower support levels around $115. |

| Macro and BTC Correlation | MEDIUM | SOL has a 0.948 correlation with the top 10 cryptos. If BTC breaks down or macro conditions worsen, SOL will likely follow regardless of its own fundamentals. |

| Sell Walls at $143-145 | LOW | Freya detected sell walls at $143 and $145. These represent concrete supply zones that will need to be absorbed before further upside. Failure to break could mean more consolidation. |

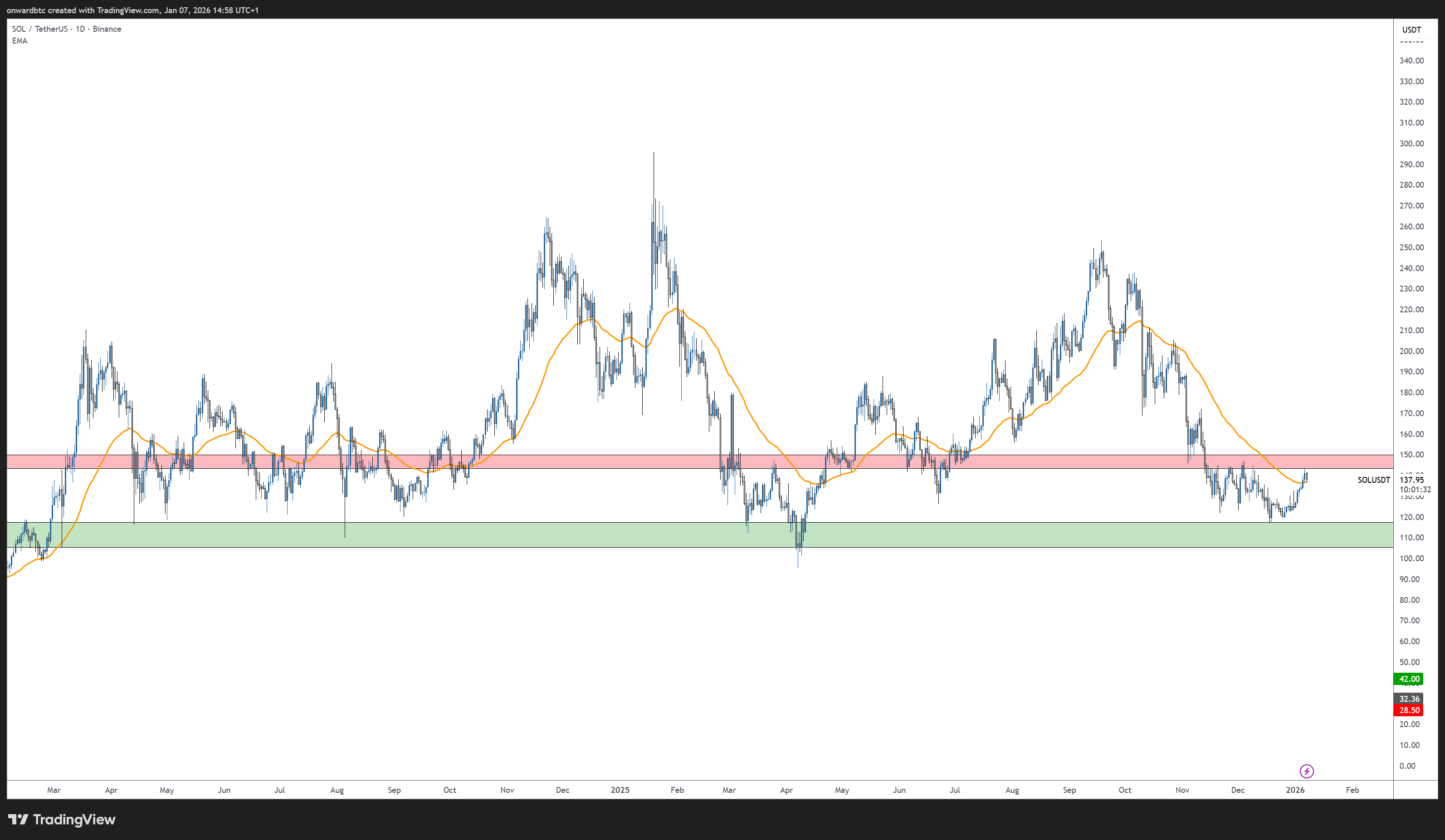

Here is what the charts are showing:

Click chart to view full size

Analysts note that $130 is the critical level to watch. A sustained hold above this level confirms the breakout structure. The $143-145 sell wall zone represents the next major hurdle. Breaking through would clear the path toward $150 and potentially a retest of the $200 region. Failure to hold $125 support could lead to a retest of the wedge support near $115.

Morgan Stanley Investment Management filed initial registration statements for a Solana Trust ETP this week. As a major global asset manager with approximately $1.8 trillion in assets under management, approval would open access to their wealth management network and signal deepening institutional commitment to SOL.

Jump Crypto's alternative validator client effort continues to progress. Frankendancer (a hybrid implementation) is now live on mainnet, with the full Firedancer client still rolling out. This increased client diversity addresses past outage concerns and has attracted high-frequency trading firms looking for institutional-grade infrastructure.

Solana's Real World Asset ecosystem reached $873 million per RWA.xyz, up 325% year-over-year. Separately, stablecoin supply on the network has grown substantially, with USDC alone exceeding $9 billion. Analysts expect diversification toward tokenized credit and ETFs in 2026 as yield markets deepen.

Bitwise's BSOL ETF stakes 100% of holdings and passes staking rewards (around 6-7% annually, variable) to investors. This yield-generating structure has helped attract flows from both retail and institutional participants looking for regulated exposure with additional returns.

Watch the $143-145 sell wall zone. A clean break with volume could signal the next leg up toward $150+. Consider scaling in on pullbacks to the $130-135 support zone with stops below $125. The skewed long positioning means volatility could be sharp in both directions.

The $1B ETF milestone and Morgan Stanley filing represent structural changes in institutional access. Consider building a position on significant pullbacks toward the $115-125 zone if you have a 6-12 month horizon. The network fundamentals (strong revenue growth, $1.5T+ DEX volume in 2025) support a longer-term thesis.

The 50-day EMA at $137 is providing near-term support. Play the range between $135 support and $143 resistance for quick scalps. Be aware of the crowded long positioning, as any break of support could trigger cascading liquidations. Size down and use tight stops.

Solana is only the fourth cryptocurrency to reach $1 billion in ETF assets under management, joining Bitcoin, Ethereum, and XRP. This milestone signals that institutional investors view SOL as a legitimate portfolio asset, not just a speculative altcoin. It also creates ongoing demand as ETF providers must buy SOL to match inflows, providing structural support for the price.

BSOL is the Bitwise Solana Staking ETF, the first U.S. ETP with 100% direct exposure to SOL. Unlike traditional spot ETFs that only track price, BSOL stakes its entire holdings through Bitwise's infrastructure (powered by Helius) and passes the staking rewards to investors. Solana staking currently yields around 6-7% annually (variable), providing additional returns on top of price appreciation.

Freya's internal data shows long positioning on SOL significantly outweighs shorts. This reflects strong conviction from leveraged traders that SOL will move higher. Recent short liquidations have further reduced short interest. While this positioning is bullish, it also creates risk: if the market turns, the crowded long side could see cascading liquidations as traders rush to exit. Note that public aggregators may show different readings depending on their data sources.

Morgan Stanley Investment Management's registration statement filing for a Solana Trust ETP signals that a major global asset manager (approximately $1.8T AUM) sees sufficient demand for SOL exposure among their clients. If approved, it would open access to Morgan Stanley's wealth management network and could encourage other traditional finance players to follow. The filing alone does not move price immediately, but it validates SOL as an institutional-grade asset.

The primary risks include: crowded long positioning that could trigger cascading liquidations if the market turns, the 53% drawdown from ATH suggesting recovery is not guaranteed, and high correlation with Bitcoin (0.948) meaning macro or BTC weakness would likely drag SOL down. Additionally, if sell walls at $143-145 continue to reject rallies, we could see extended consolidation or retests of lower support.

Freya monitors markets 24/7 and delivers insights like these directly to your Telegram. Long/short ratios, whale movements, liquidation levels, and actionable price targets.

Try Free for 30 DaysNo credit card required. Cancel anytime.

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency trading involves substantial risk of loss. Past performance does not guarantee future results. The price data, positioning analysis, and technical levels presented are based on available information at time of publication and may change rapidly. ETF AUM and flow data is sourced from SoSoValue and public filings. Long/short positioning data referenced as "Freya detected" is from internal monitoring systems. Always do your own research and consider your financial situation before making investment decisions. Never invest more than you can afford to lose.