Data from CoinMarketCap & Alternative.me as of Dec 31, 2025. Verify before trading.

Zcash has been the quiet monster of 2025. While Bitcoin struggles below $90,000 and most altcoins bleed, ZEC has delivered returns north of 800% year-to-date. It went from roughly $58 in January to a multi-year high of $744 in November.

Now two major forces are converging. Arthur Hayes, the former BitMEX CEO known for market-moving calls, publicly declared that $1,000 is just the "first stop" for ZEC. Within 48 hours, Cypherpunk Technologies (backed by the Winklevoss twins) announced a $29 million purchase, bringing their total holdings to nearly 2% of all circulating Zcash.

That is institutional money betting on privacy at scale. Freya has been tracking the on-chain signals all week, and the data tells a story worth understanding. This article breaks down what we are seeing, the levels that matter, and the risks you need to consider.

Who this is for: Traders watching the privacy coin narrative unfold and looking for data-driven context on ZEC's momentum. We present the signals. You make the decisions.

Zcash is a privacy-focused cryptocurrency launched in 2016 by a team of cryptographers and scientists. It was built on Bitcoin's codebase but introduced zero-knowledge proofs (zk-SNARKs) to enable fully private transactions. Unlike Bitcoin, where all transactions are publicly visible on the blockchain, Zcash allows users to shield their transaction details while still proving validity.

Users can choose between "transparent" transactions (similar to Bitcoin) and "shielded" transactions (fully private). The protocol has evolved over the years, with the introduction of Halo (trustless zero-knowledge proofs) and Unified Addresses that simplify the user experience. Zcash shares Bitcoin's fixed supply of 21 million coins and follows a similar halving schedule.

Our market intelligence system flagged significant accumulation signals and whale activity around ZEC. Here is what stood out:

Freya detected notable ZEC withdrawals from major exchanges this week, including movement from Binance and Kraken. Exchange withdrawals typically signal accumulation, not selling.

This pattern aligns with the broader trend: whale wallets control a substantial portion of ZEC supply. When large holders pull coins off exchanges, they are reducing available sell-side liquidity and preparing for longer-term holds.

Cypherpunk Technologies announced on December 30 that they purchased 56,418 ZEC for $29 million at an average price of $514. Their total holdings now stand at 290,062 ZEC, representing 1.76% of circulating supply.

The company has stated a goal of accumulating 5% of the entire Zcash network. With Winklevoss Capital backing and Zcash co-founder Zooko Wilcox serving as an advisor, this is not speculative retail buying. It is a treasury strategy built around the thesis that privacy will be repriced higher.

Estimates suggest 25-30% of all ZEC is now held in shielded addresses, up significantly from earlier this year. These coins are essentially removed from immediate tradable supply. Combined with exchange outflows, this creates a classic supply squeeze: less ZEC available for sale while institutional demand increases.

The momentum is real, but so are the risks. Privacy coins face unique challenges that other cryptocurrencies do not. Here is what you need to consider:

| Risk Factor | Level | Details |

|---|---|---|

| Regulatory Pressure | HIGH | Privacy coins face ongoing scrutiny globally. Multiple exchanges have delisted ZEC in certain jurisdictions. A coordinated crackdown could slash liquidity and drive prices back to $200-300. |

| Thin Liquidity | HIGH | Whale wallets control a substantial portion of supply, and an estimated 25-30% is held in shielded addresses. Available liquidity is thin, which amplifies both upside and downside moves. |

| Technical Pullback Risk | MEDIUM | Analyst Eric Van Tassel noted a rising wedge pattern that could trigger a "normal reset" to $400 before continuation. After an 800%+ run, corrections are healthy and expected. |

| Leverage and Liquidations | MEDIUM | Open interest hit $1.3B in late December. High leverage environments are sensitive to sudden moves. Liquidation cascades can accelerate downside quickly. |

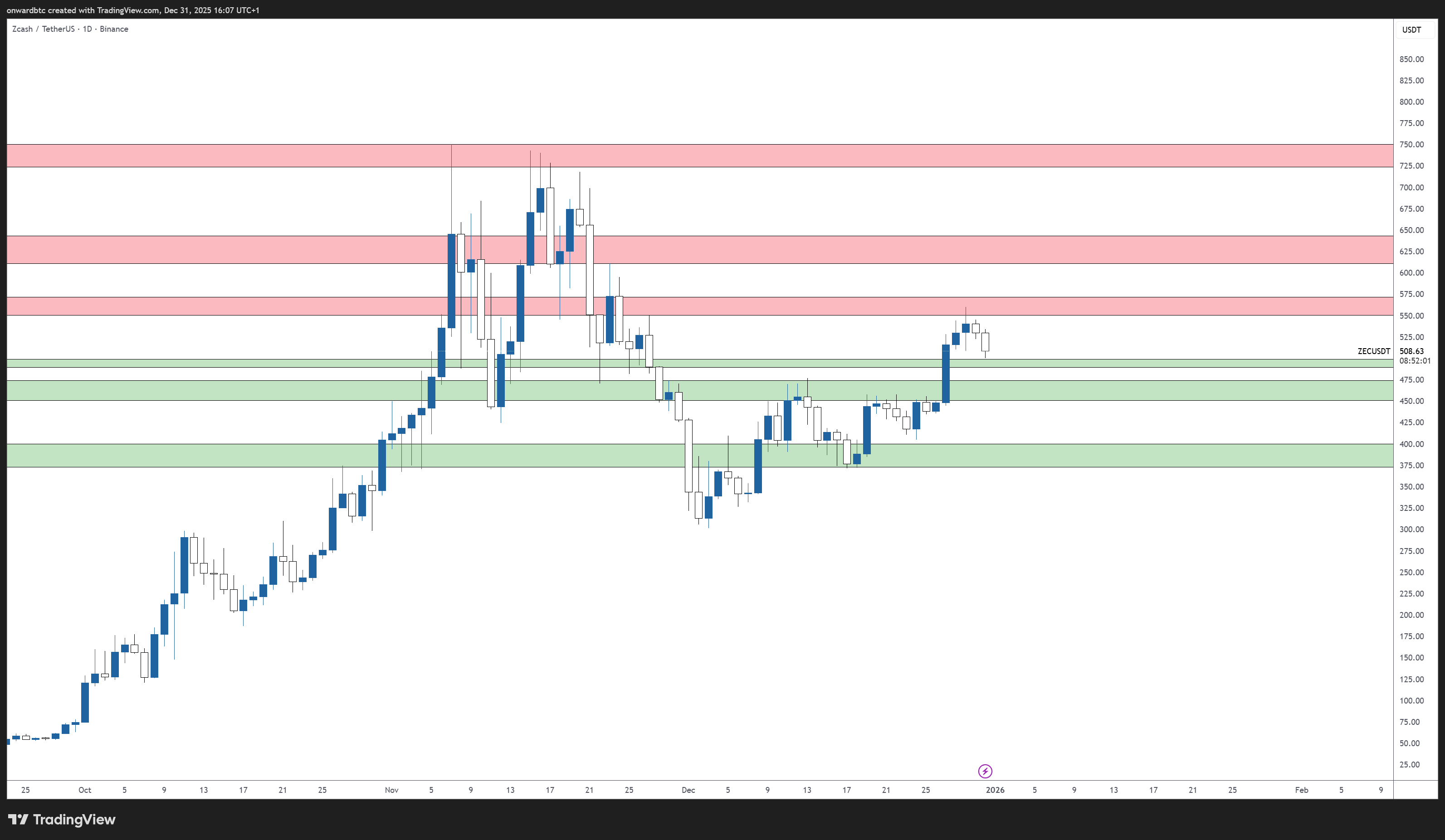

Here is what the charts are showing:

Click chart to view full size

ZEC reached an all-time high of $744.13 on November 7, 2025. It is currently down about 30% from that peak but remains up more than 800% year-to-date. The token started 2025 around $58. After a move this large, volatility works both ways.

Hayes tied his ZEC thesis to macro liquidity returning through "short-term funding operations" rather than explicit QE. If risk appetite returns in early 2026, privacy coins could be a dominant narrative. His October 2025 call preceded ZEC's rally from roughly $75 to $775.

Cypherpunk currently holds 1.76% and has stated plans to reach 5% of total Zcash supply. At current prices, that would require another $250M+ in purchases. Their continued buying creates consistent demand pressure and signals long-term institutional conviction.

Grayscale's Zcash Trust has existed since 2017, providing accredited investors with ZEC exposure. In late 2025, renewed attention emerged around a potential Zcash ETF filing, similar to the path Bitcoin and Ethereum followed. This could open ZEC to broader institutional participation.

Zcash's second halving occurred in November 2024 (the next is expected around 2028). The reduced issuance acts as a supply inflection point, contracting new coin availability. The effects of halvings often play out over the following 12-18 months, and ZEC's 2025 rally may reflect this dynamic.

The $470-500 zone is your area of interest for entries. Freya flagged confluence at $470s. If ZEC holds $500 and breaks $550 with volume, the next target is $600 and potentially $744 ATH. If $470 fails, expect $400. Size accordingly for volatility.

The institutional setup is compelling for a 6-12 month view. Cypherpunk's ongoing accumulation, Hayes' thesis, and supply dynamics suggest structural demand. Consider building in tranches if price reaches the $400-470 zone. The regulatory risk is real, so size for asymmetric outcomes.

$550 and $600 are clear rejection points for shorts if momentum stalls. The $500-520 zone offers bounce plays. With $1.3B in open interest and high leverage, liquidation cascades can create fast moves in either direction. Tight stops are essential.

Hayes believes that liquidity will return to markets through indirect Fed operations rather than explicit QE. In that environment, he sees privacy and zero-knowledge technologies re-emerging as a dominant narrative. ZEC is a liquid way to express that thesis. His October 2025 endorsement preceded a significant rally from roughly $75 to multi-year highs.

Cypherpunk is a Nasdaq-listed company backed by Winklevoss Capital (the twins behind Gemini). They rebranded from Leap Therapeutics in November 2025 and are building a Zcash-focused treasury. Their 5% supply target and $97M+ in purchases signal institutional conviction, not speculation.

Zcash pioneered zero-knowledge proofs (zk-SNARKs) for blockchain privacy and has evolved to trustless Halo proofs. Unlike Monero which is always private, Zcash offers optional privacy. This gives users choice and may help with regulatory compliance. Its Bitcoin-like tokenomics (21M cap, halvings) also differentiate it.

We do not give investment advice. What we can tell you: ZEC is still below its 2025 ATH of $744 and well below its 2017 all-time high. Institutional buyers are accumulating at current prices. However, 800% gains often precede corrections. Consider your risk tolerance and time horizon carefully.

Regulatory pressure is the primary concern. Privacy coins have been delisted from exchanges in multiple jurisdictions (though some like the US allow ZEC with KYC). A coordinated crackdown could severely impact liquidity. Additionally, whale wallets control a substantial portion of supply, making the market thin and volatile. Leverage liquidations can cascade quickly.

Freya monitors markets 24/7 and delivers insights like these directly to your Telegram. No charts to decode. No confusion. Just professional intelligence when it matters.

Try Free for 30 DaysNo credit card required • Cancel anytime

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency trading involves substantial risk of loss. Past performance does not guarantee future results. The price data, on-chain analysis, and technical levels presented are based on available information at time of publication and may change rapidly. Privacy coins face unique regulatory risks that could significantly impact their value. Always do your own research and consider your financial situation before making investment decisions. Never invest more than you can afford to lose.